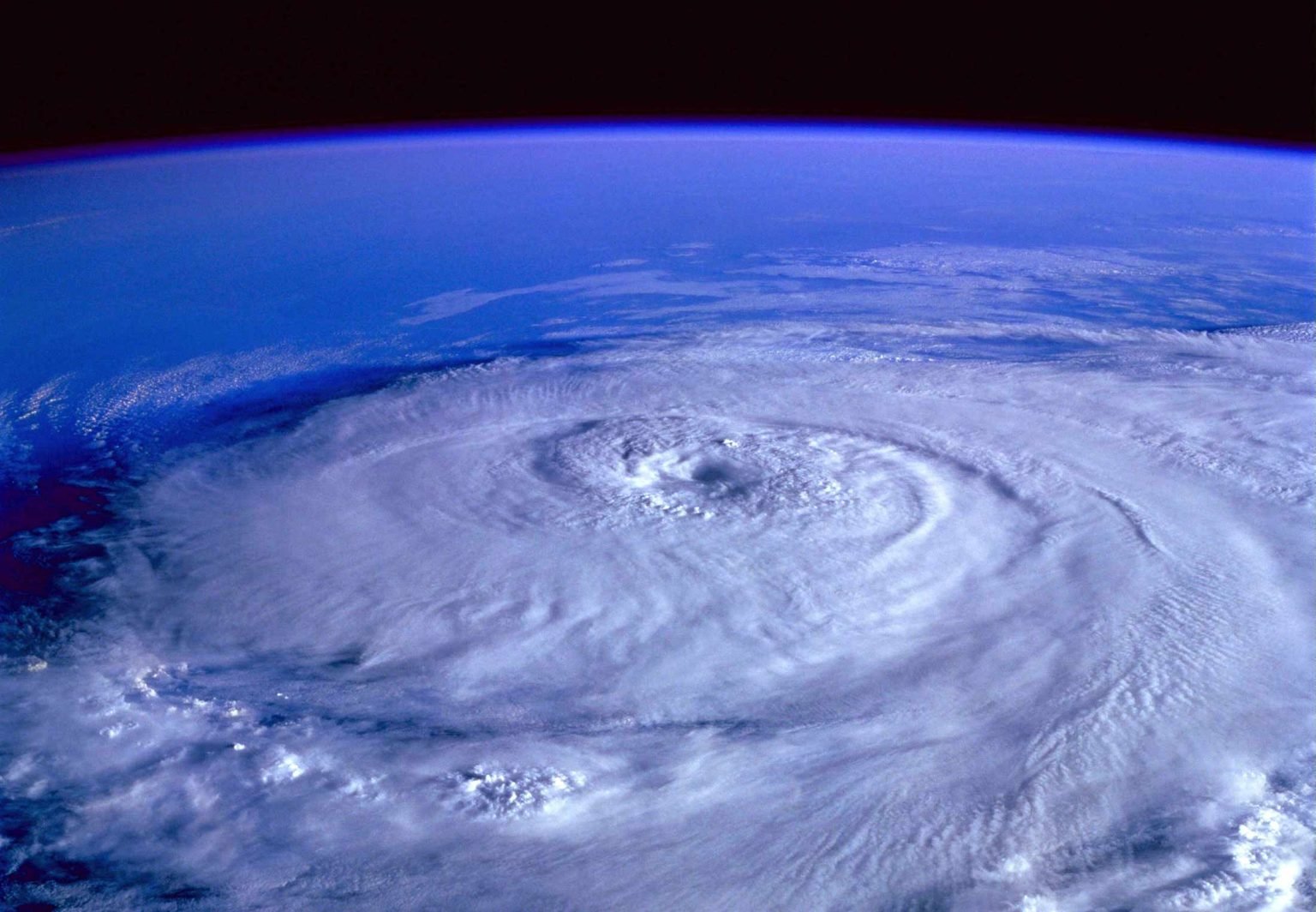

Are you prepared for hurricane season?

Explore Liberty’s Hurricane Support Hub for risk insights, insurance guidance, and expert resources to help you protect what matters most.

Supercharge M&A Deals with Expert Insights

The world of M&A can seem elusive, but today’s guest lifts the curtain to reveal how lower middle market firms can achieve global reach and expertise. In this episode, Nick Olsen, Managing Director of Cornerstone International Alliance, delves into the power of collaboration within the M&A network, highlighting how firms

What Type of Retirement Plan Should My Business Implement? – Part 8

The Benefits of Saving in a Retirement Plan or IRA Why should someone save in an IRA or a retirement plan, instead of a regular savings account? Individual Retirement Accounts (IRAs) and retirement plans provide tax advantages that a regular savings account does not. There are two types of tax advantages: Pre-tax: Making a traditional IRA contribution or

What Type of Retirement Plan Should My Business Implement? – Part 7

Safe Harbor 401(k) Plan Basics A safe harbor 401(k) plan is simply a 401(k) plan that includes a safe harbor feature. There are a few options when it comes to the safe harbor feature, but by electing this feature, the employer commits to making minimum contributions to their employees. This

What Type of Retirement Plan Should My Business Implement? – Part 6

SIMPLE 401(k) Plan Basics A SIMPLE 401(k) plan is a combination of a regular 401(k) plan and a SIMPLE IRA. When would a business choose this plan over a SIMPLE IRA or regular 401(k) Plan? NOT OFTEN. The SIMPLE 401(k) doesn’t provide meaningful advantages when compared to the SIMPLE IRA or 401(k)

What Type of Retirement Plan Should My Business Implement? – Part 5

SIMPLE IRA Plan Basics A SIMPLE IRA plan allows employees to make contributions to a retirement plan from their pay just like a 401(k) plan, but the maximum deferral amount is lower ($16,500 vs $23,500.) Why would a business choose this plan over a 401(k) Plan? Usually because of the ease of getting this type of plan started and its typically low administrative

What Type of Retirement Plan Should My Business Implement? – Part 4

401(k) Plan Basics A 401(k) plan allows employees to make contributions to a retirement plan from their pay. This is called a 401(k) deferral because instead of receiving all of their pay, the employee directs the employer to deposit a portion of their pay in the retirement plan. Saving in

What Type of Retirement Plan Should My Business Implement? – Part 3

In Part 2, we discussed that 401(k) plans are a good retirement plan to consider when trying to attract and retain top talent for your business. But what are your 401(k) plan options? There are quite a few and we provide practical pointers to help you understand why a business might choose

What Type of Retirement Plan Should My Business Implement? – Part 2

In Part 1, we talked about how a SEP plan can work nicely for an owner of a business with no employees. But what is the right plan for a company with employees? Usually the best place to start is finding out the answer to this question: Why does the business