Home » Commercial Insurance » Workers’ Compensation

Workers' Compensation

Take Ownership of Your Company's Workers' Compensation Process

As Workers’ Compensation expenses continue to grow for employers of every size and across all industries, understanding and addressing the many hidden costs allows companies to take control of their Workers’ Compensation programs.

The Liberty Company utilizes proprietary analytics, experienced claims advocates, and a proven, wholistic consultative process to allow employers to take ownership of the Workers’ Compensation process.

Unlocking Success: Begin Your Journey with Liberty’s Holistic Workers’ Compensation Solutions

Explore how Liberty’s National Workers’ Compensation Practice

leverages over 150 years of collective experience in claims consulting

and risk management to transform the complexities of workers’

compensation into strategic opportunities for cost reduction,

enhanced safety, and optimized workforce productivity.

Why Choose Liberty for Workers' Compensation?

Analytics that help you save

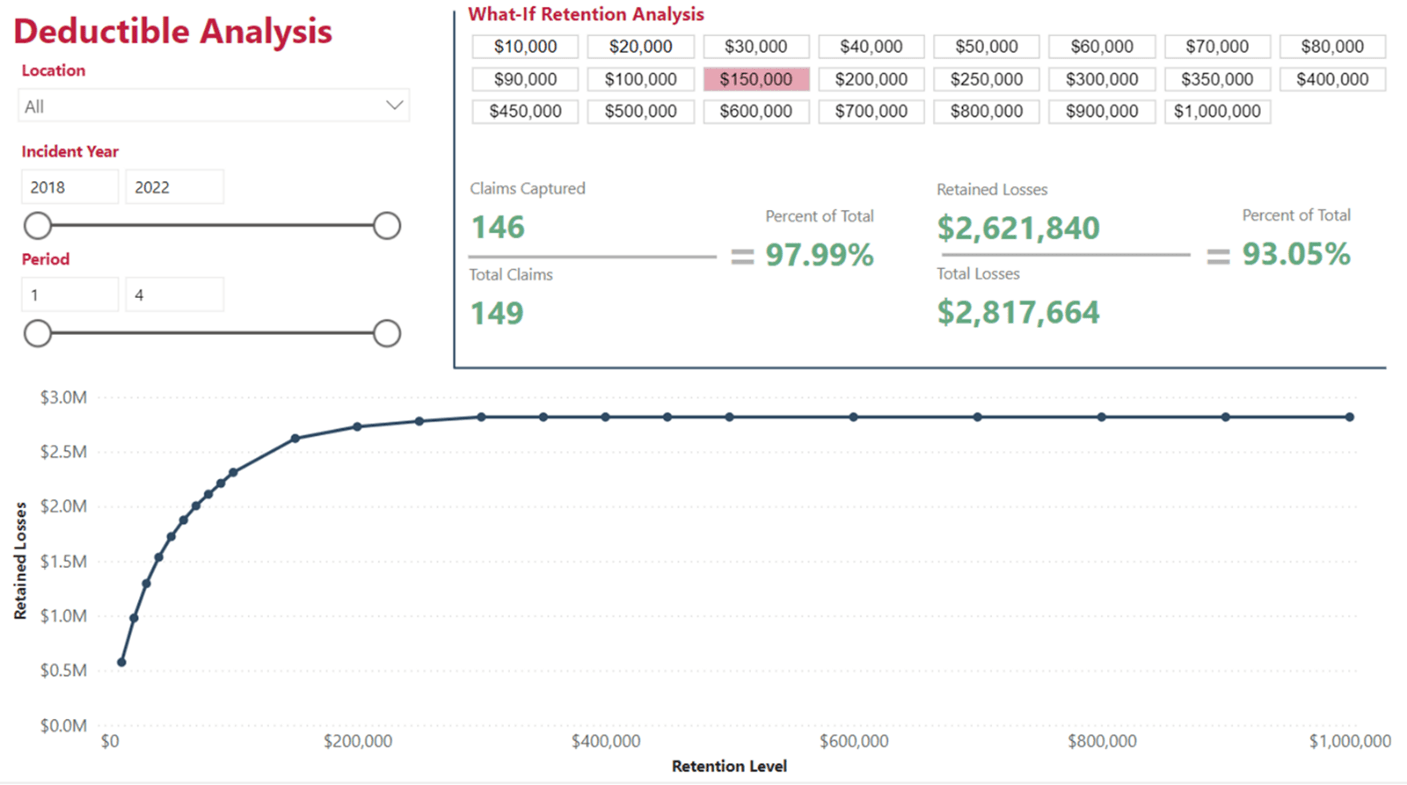

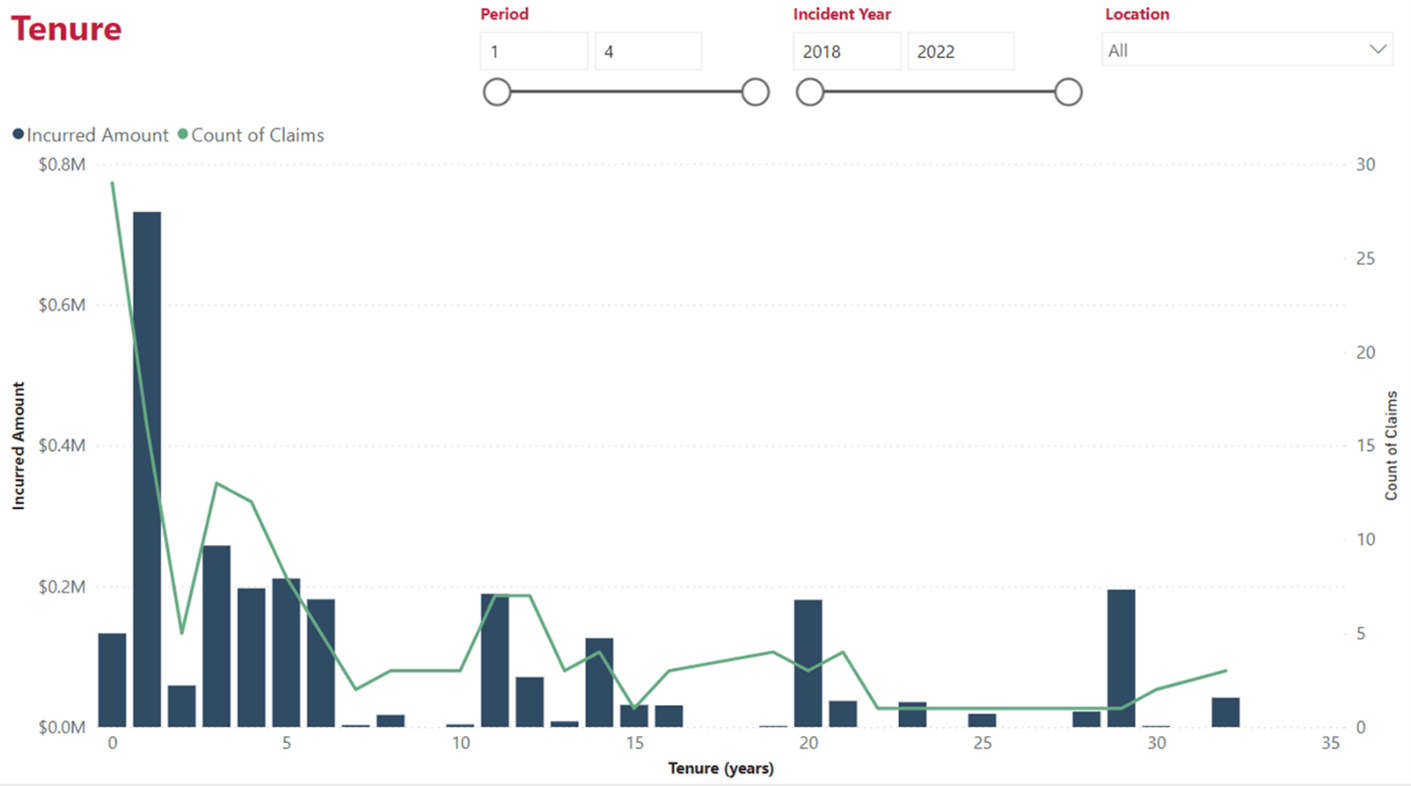

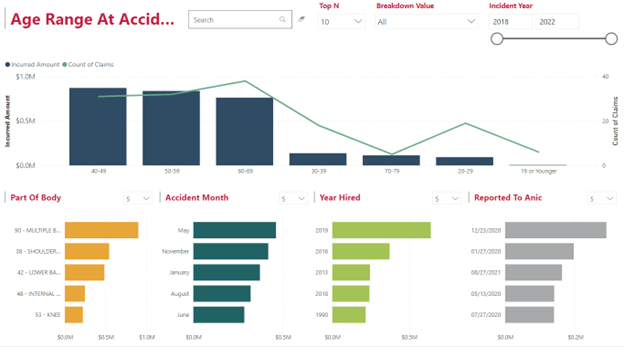

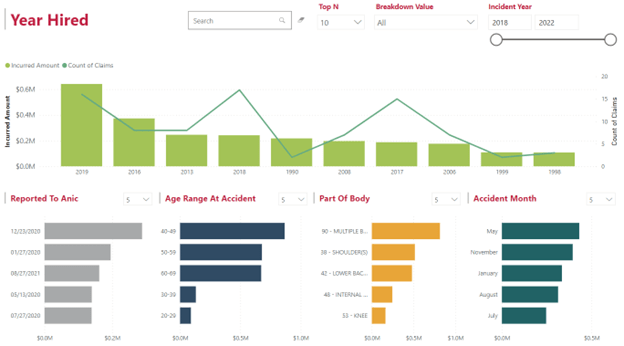

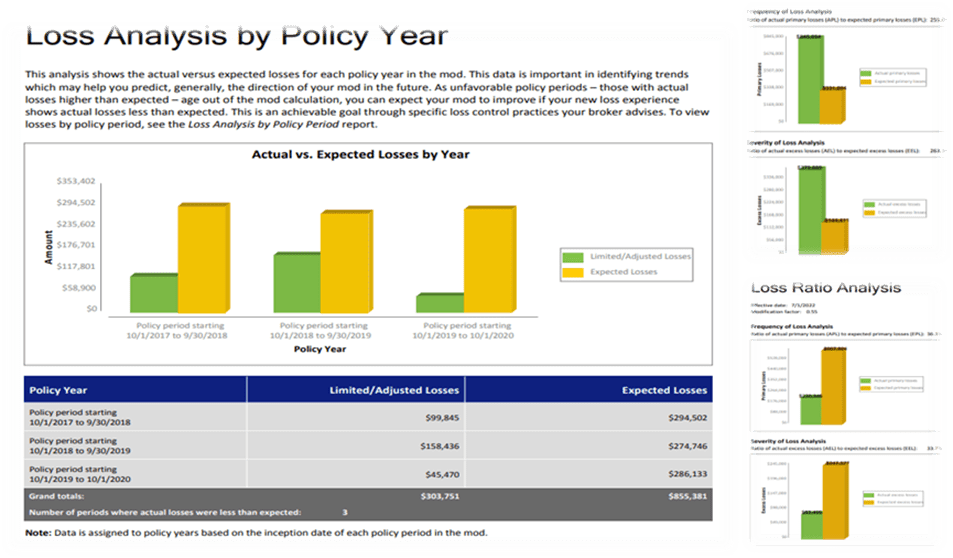

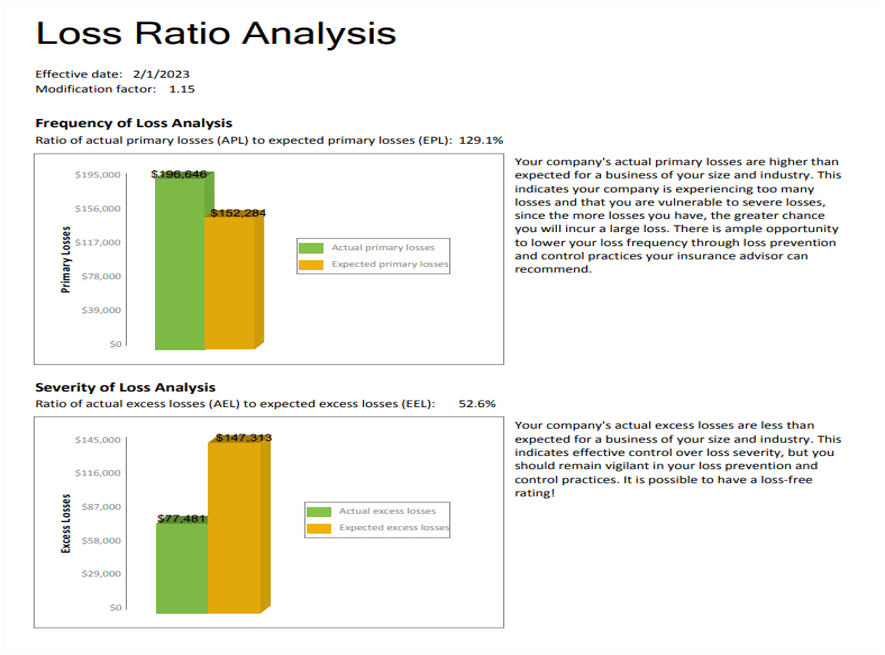

Our Analytics team dives into your data and extrapolates key cost drivers.

Experienced Claims Consultants

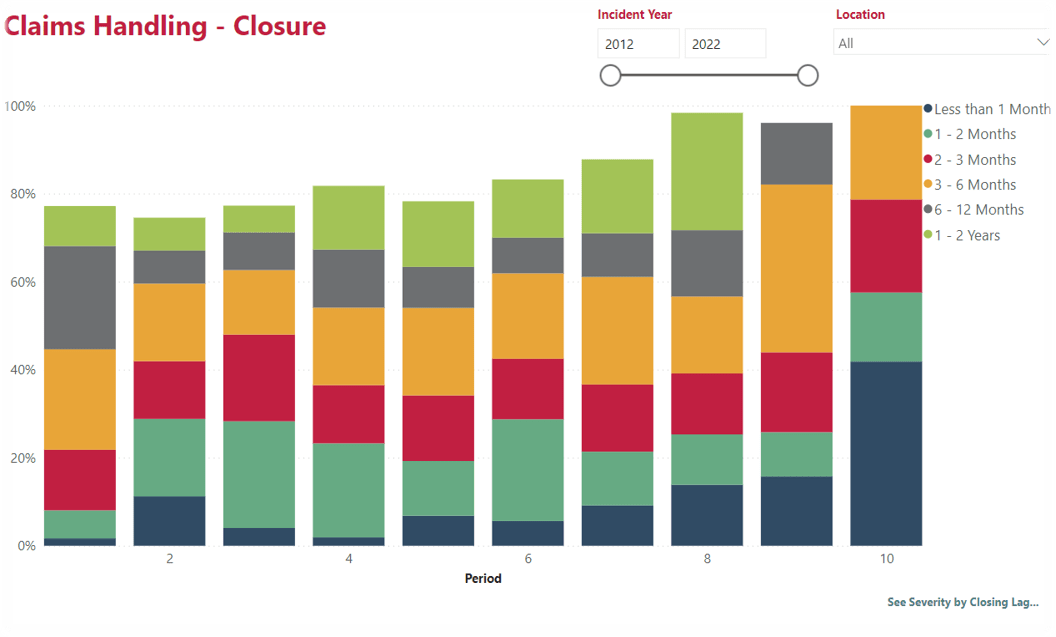

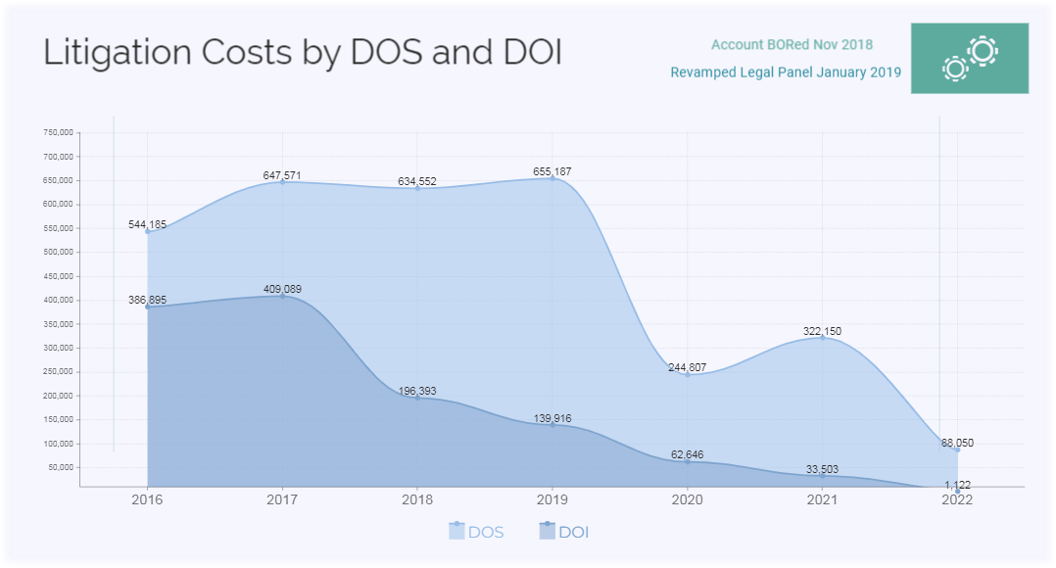

Our team of experienced Claims Consultants then uses those data points to determine mitigation strategies that result in long-term cost minimization.

Minimize your premium and collateral requirements

Our Risk Managers use these results to leverage against the open market in order to minimize your premium and collateral requirements, which means more money in your pocket.

Take Control of Your Workers' Comp

VIDEO: Workers' Compensation Practice Group Overview

What Workers' Compensation Coverage Options Are Best for Your Business?

At Liberty, our team of experts can help you find the right coverage at the right price for your business.

Navigating Emerging Complexities in the Workers’ Compensation Market: Liberty’s Holistic and Consultative Approach to the Aging Workforce

Program Consulting

Our Risk Managers and Claims Consultants act as a member of your team to maximize the efficiency of your program. Our proven track record of reducing our clients total Workers’ Compensation costs is achieved by:

- Advanced Analytics and Predictive Modelling

- Tailored Program Design and Implementation

- Human Resources Consulting

- Training and Development

- Claims Mitigation and Advocacy

- Legal Panel Management

Together, these differentiators give employers power to anticipate expenses, develop customized solutions, reduce injuries, and mitigate claim costs.

What Workers' Compensation Coverage Options Are Best for Your Business?

At Liberty, our team of experts can help you find the right coverage at the right price for your business.

What Workers' Compensation Coverage Options Are Best for Your Business?

At Liberty, our team of experts can help you find the right coverage at the right price for your business.

Workers' Compensation Articles & Resources

Frequently Asked Workers' Compensation Questions

Is workers’ comp required by law?

Yes! Every state requires some sort of workers’ compensation coverage for businesses with a certain number of employees. Additionally, certain industries have federal programs that require a certain level of workers’ comp coverage (i.e. railroad workers, longshore and harbor workers, defense contractors, oil rig workers, etc.)

How can I control my Workers’ Compensation costs?

Workers’ comp premiums are calculated based on the risks your company faces and the number of employees you must cover.

How do I know if my program is effective?

There are a couple of indicators that your program is not operating properly – high claim severity costs, little to no advocacy, minimal analytics, to name a few – but if you are asking the question, you already know the answer. At Liberty, we recommend you choose our team of experts because we offer expert guidance, quotes from all the best carriers, claims support, and a host of other options that will maximize the performance of your business.

Should I Self-Insure?

At Liberty, we believe walking to a new program, not running, is the best approach to fully understand what is ideal for your company. Self-funding/partial self-funding and captive insurance products can be beneficial for particular risk profiles. Our experts can analyze and evaluate your needs and goals to determine what the best options are for your business, providing services to place or build alternative insurance products.