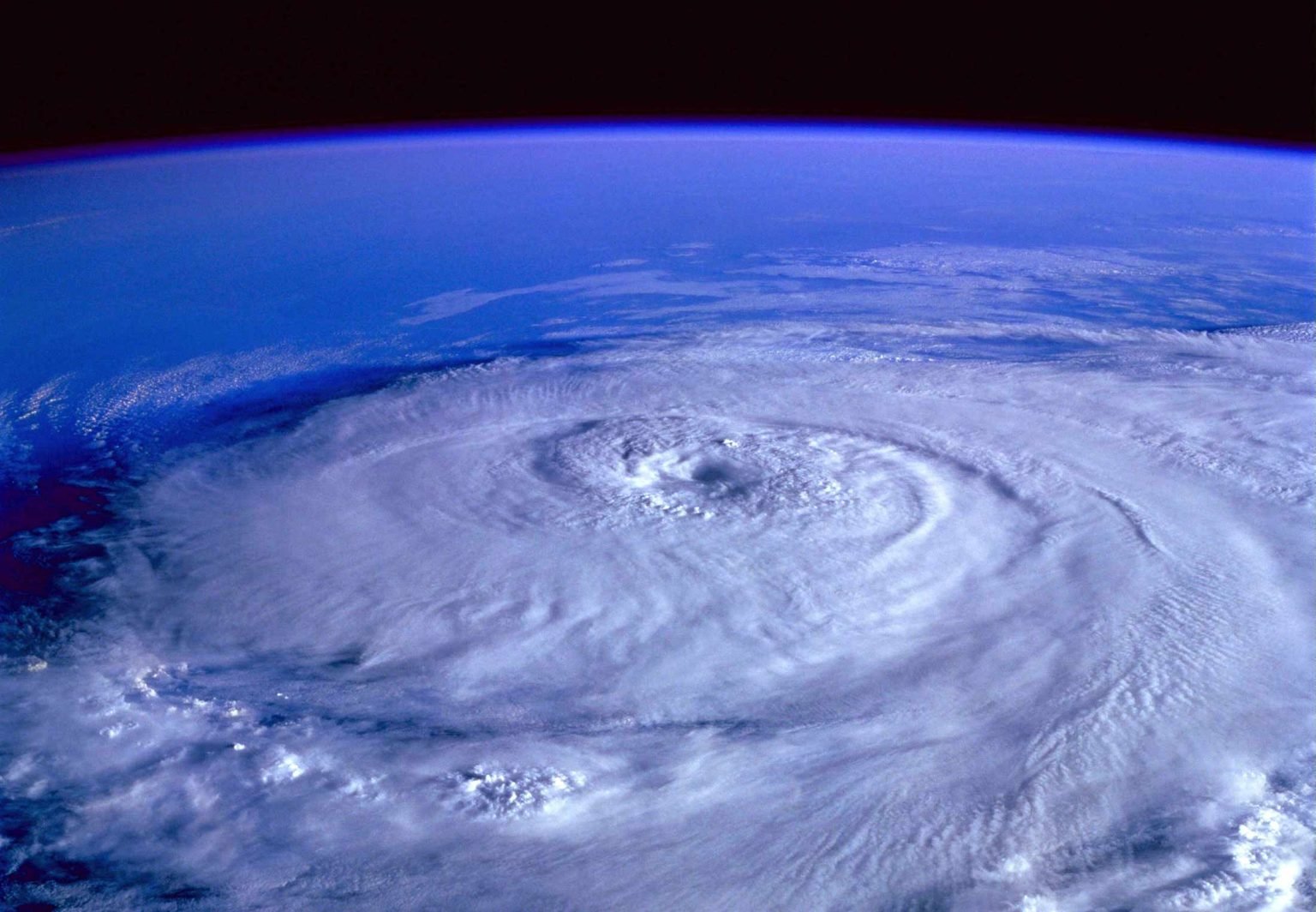

Are you prepared for hurricane season?

Explore Liberty’s Hurricane Support Hub for risk insights, insurance guidance, and expert resources to help you protect what matters most.

Sean Edmonson and Adam Deutsch | Transactions with Transparency and Trust

On this week’s episode of M&A Masters, we speak with Sean Edmondson and Adam Deutsch. Sean is Vice President at Tecum Capital, a middle market multi-strategy private equity investment platform, and Adam Deutsch is the Director, Co-founder, and CFO of NewHold Investment Corporation, a holding company and private investment firm.

My Why – and Why You Should Secure Representations and Warranty Insurance for Your Next Deal

For many, an IPO is the most exciting event in the life of a business. But I liken it to a team’s top pick in the NFL draft because the IPO itself is just the beginning. There are a lot of expectations for the player (or company) … and it

Sean Alford | Clarifying Strategies and Processes During the Pandemic

On this week’s episode of M&A Masters, we’re joined by special guest, Sean Alford, Senior Vice President of Corporate Development at J2 Global, an internet information and services company that includes IGN, Mashable, Humble Bundle, and more across digital media and cloud services segments. Sean says, “It’s pretty systematized

Top 5 Home Insurance Questions Answered

Whether it’s your first time buying a house, or you’ve lived in the same house for 50 years, it’s probably time to check your home insurance.

Suzanne Yoon | Using Technology to Compound the Effects of Good Capital and Great Operations

On this week’s episode of M&A Masters, we speak with Suzanne Yoon, Founder and Managing Partner of Kinzie Capital Partners, a private equity firm based in Chicago. Mergers and Acquisitions Magazine named Suzanne 2020’s most influential woman in mid-market M&A, and she’s also been recognized by The Wall Street Journal

Emerging Trends in R&W Claims

As the major player in the industry, AIG has been the long-standing, nearly sole source of claims information for the Representations and Warranty (R&W) insurance market. In 2020, Liberty Mutual, which has been actively writing M&A-oriented policies for about 10 years, issued its first such report based on their own

The Liberty Company Insurance Brokers Welcomes Marty Callahan

Los Angeles, December 4th, 2020 — The Liberty Company Insurance Brokers announced today that Marty Callahan has joined the team as Vice President, Liberty San Clemente.