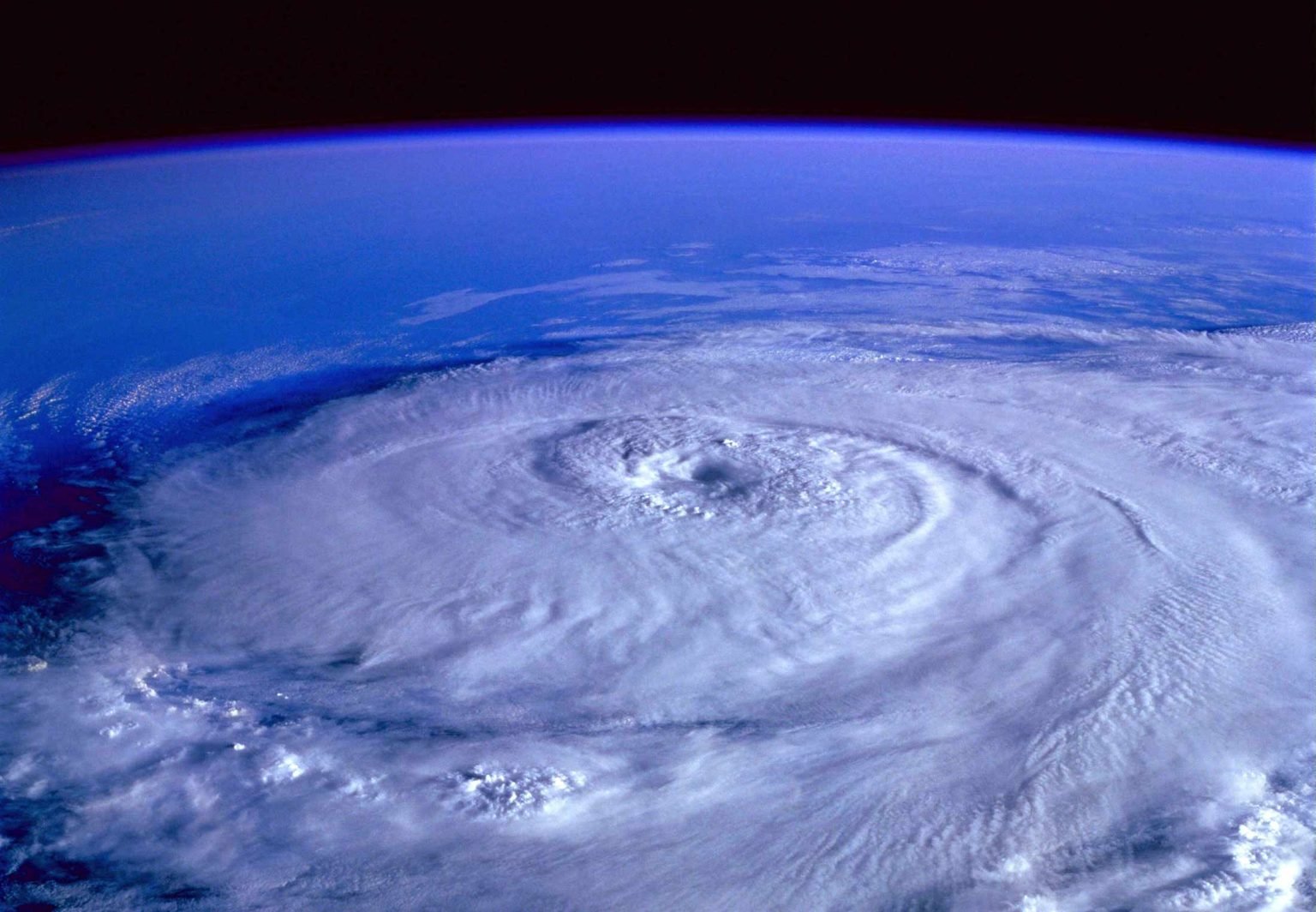

Are you prepared for hurricane season?

Explore Liberty’s Hurricane Support Hub for risk insights, insurance guidance, and expert resources to help you protect what matters most.

Liberty Introduces Chris Camero As Vice President, Benefits Consultant

GAINESVILLE, FLA. – January 25, 2022 —The Liberty Company Insurance Brokers (Liberty) is proud to announce that Chris Camero has joined the firm as Vice President, Benefits Consultant. Bringing more than 30 years of benefits and insurance experience to Liberty, Camero excels at guiding employers in the design, funding, administration

Alan Clark | Why This Major 2023 Prediction is Wrong

When your small business owner client is in a room full of MBAs, they can feel out of their depths… So how do you keep your client’s emotions in check during a high-stakes sale? Alan Clark is here to share his perspective as a sell-side advisor helping clients exit their

Co-Op Fire Safety: 5 Tips

Living in a co-op can be a rewarding and affordable experience, but you still need to make sure that you are mindful of fire hazards. Many residents live the majority of their lives in the co-op, and you want to maintain the building and your unit to the highest standards

Top Tips for Managing Windows and Doors in a Co-Op

Co-ops are a great way to get into real estate with limited funds, but they can also be a challenge to maintain. That’s because they’re yours, but they’re also part of a much larger community with a maintenance team. What’s yours to fix and what’s not? The good news is

Whole vs Term Life Insurance: What’s the Difference?

While whole life insurance is considered the more valuable and of the two, it offers more than a lifetime of protection for a single premium. Term life insurance, however, simply has the insurance company will pay a large sum of money to the beneficiary—if the insured dies. Whole life insurance

Breaking Down Your Transactional Liability Insurance Options: No Insurance, Traditional Buy-Side, and New Sell-Side

When looking at options to cover a M&A transaction in the past, we’ve always said that you could either use traditional Representations and Warranty (R&W) insurance or… nothing. Nothing would often be the case for deal sizes under $20M, where R&W coverage simply does not extend these days except in

TLPE Case Study: Buyer Uses TLPE to Win Auction on Desirable $13M Tech Company

For many years, it was standard practice for Sellers in M&A deals with leverage to insist that Buyers forgo escrows as part of the terms of their deal and instead use Representations and Warranty (R&W) insurance. However, there is a catch … This process works only if the target’s pricing

Clint Tripodi | How to Set a Strategy And Execute It

As we prepare for the new year, it’s time to set your strategy… “What strategy?,” you might think, “We just need to make more money.” But a business without a strategy is destined for failure. Especially in today’s changing world, where an unexpected crisis could derail your business. And it’s