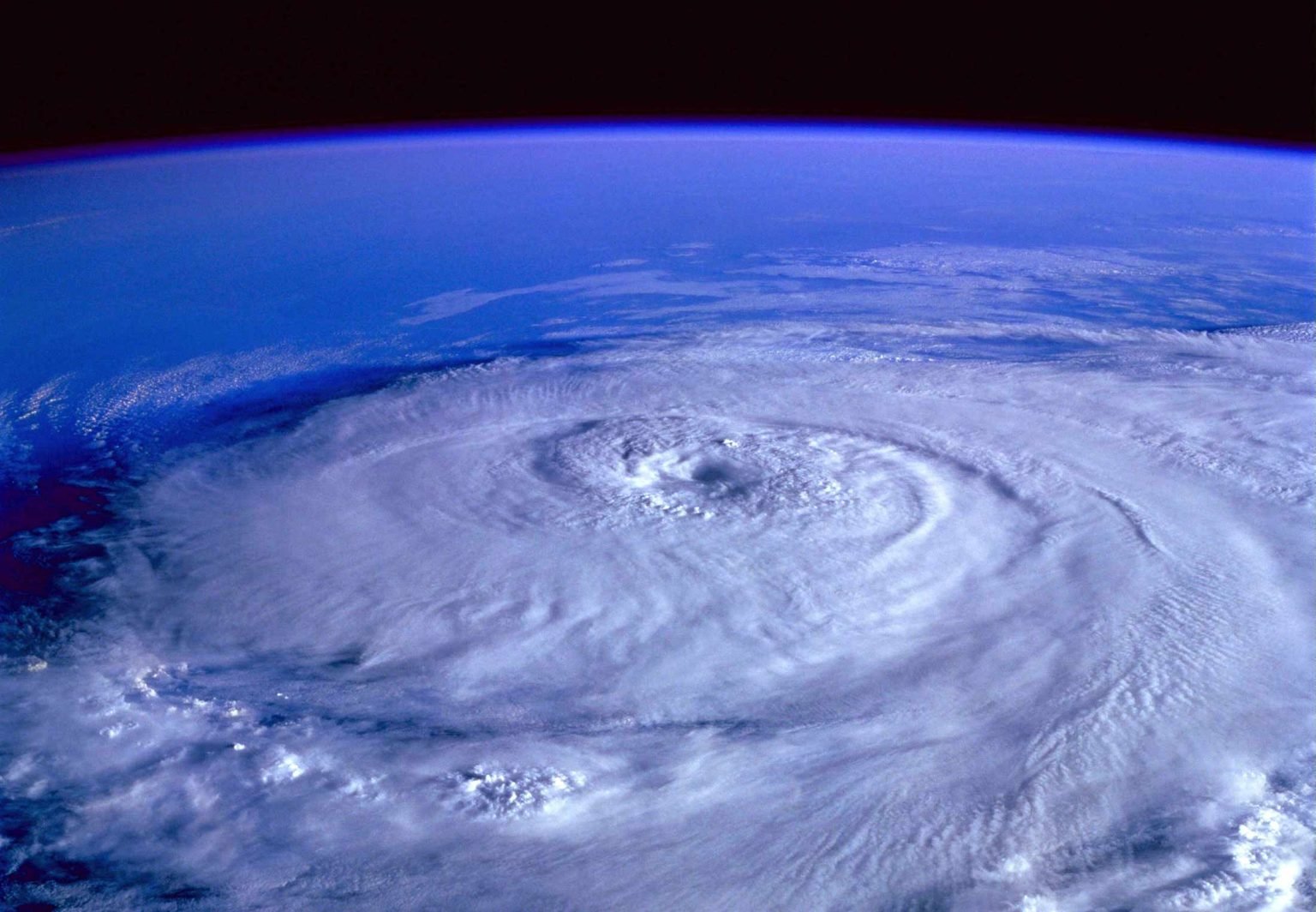

Are you prepared for hurricane season?

Explore Liberty’s Hurricane Support Hub for risk insights, insurance guidance, and expert resources to help you protect what matters most.

How to Cooperate Effectively with Underwriters Throughout the Rep and Warranty Lifecycle

I have a surprising truth for you. It goes against everything you’ve been taught or experienced when it comes to insurance companies.

With Rep and Warranty Claims, It Pays to “Spill Your Guts” to Your Insurer

When it comes to standard car, home, or health insurance, policyholders tend to play it close to the vest. They won’t freely give information above what the insurance company requires, and if the insurer starts asking questions, especially about a claim, they get downright defensive. They’re worried the company is

Rep and Warranty Coverage Now Widely Available for Smaller M&A Deals

Up until very recently, rep and warranty insurance, which offers many advantages to buyers and sellers during mergers and acquisitions, has been available primarily with deals worth $50 million or more. But good news for those involved in smaller deals.

Why Strategic Buyers Don’t Need Rep and Warranty but Shouldn’t Do a Deal Without It

A couple of years back, I witnessed a train wreck of an acquisition that could have gone much, much smoother if the parties involved had taken one extra, but very low cost, step as they put together the deal. Let me set the scene. The owner of a telecommunications company

How Much Does R&W Coverage Cost? It’s Much Less Than You Might Think and the Value is Priceless

Representations and warranties insurance should be part of any large-scale merger or acquisition deal. Such a policy puts the risk in a business transaction away from buyer and seller and onto a third party – an insurance company.

The Audi and Silvercar Acquisition Case Study and… How You Can Protect Yourself in Your Own M&A Deals

In March 2017, luxury automaker Audi, part of the Volkswagen Group, announced they were buying Silvercar, a distinctive and disruptive rental car company known for its fleet of Audi A4s in, what else, silver.

Four Ways to Protect Yourself From the Fiduciary Liability Litigation Machine

The scene – an unnamed company. A new CFO was appointed and installed as the 401(k) plan administrator. He replaced the 12 investment options offered before with three mutual funds. It turns out his brother managed those funds. A clear conflict of interest with regard to the 401(k) plan –

Welcome, Sheldon Mowrey To The Liberty Team

The Liberty Company Insurance Brokers is pleased to announce and welcome its newest member, Sheldon Mowrey, who will join the Liberty team in our Employee Benefits Division as Vice President/Producer in our Los Angeles office in Woodland Hills, CA